Union Dues Suspension: What It Means for Your Insurance

In recent weeks, federal employees across multiple agencies have noticed unexpected changes in their payroll deductions—specifically related to union dues suspension. While this may seem like a technical adjustment, it could have direct consequences on supplemental insurance benefits, including life, dental, and vision coverage.

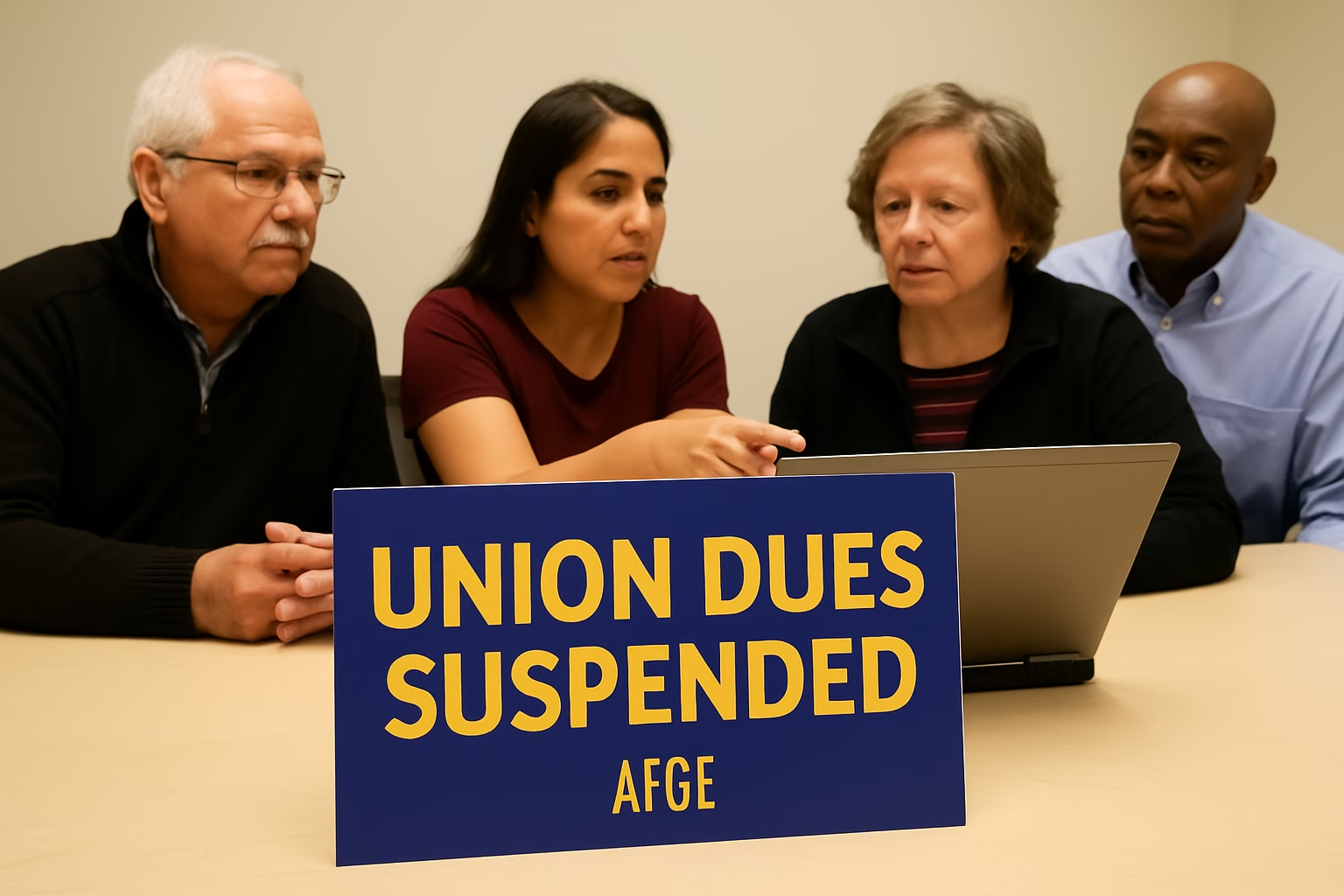

As reported by Government Executive, the federal government halted automatic union dues deductions at several agencies following a recent executive order, with some unions and employees not receiving prior notice.

What Happened?

A recent executive order has allowed certain federal agencies to become exempt from federal labor laws under national security provisions. As a result, the government’s three main payroll processors suspended the automatic deduction of union dues, in many cases without notifying employees, agencies, or unions.

In some instances, dues were deducted but not transferred to the unions, disrupting membership status and creating confusion around eligibility for union-linked benefits.

How Does This Affect Insurance Coverage?

The suspension of union dues can jeopardize the continuity of insurance coverage that employees receive through union membership. These benefits are often conditional on active union status, which is verified through regular dues payments.

If dues are not being deducted—and no direct payment alternative is established—coverage may be paused or canceled without notice.

The most commonly affected benefits include:

- Supplemental life insurance

- Dental insurance

- Vision insurance

- Disability coverage

- Legal or financial assistance plans

Several unions have already reported cancellations of dental and vision coverage linked to interrupted payments. This highlights the importance of reviewing your membership status and confirming your insurance coverage.

What Alternatives Are Available?

Some unions, such as the American Federation of Government Employees (AFGE), have implemented platforms like E-Dues, allowing members to make secure payments directly by credit card or bank draft, independent of government payroll systems.

These platforms aim to:

- Keep union membership active

- Ensure continued access to benefits and coverage

- Give employees greater control over their financial data

Other unions are in the process of implementing similar systems.

What Can Federal Employees Do Now?

If you’re a federal employee, consider these steps:

- Review your most recent pay stub to check if union dues are still being deducted.

- Contact your union to confirm your membership and coverage status.

- Ask about E-Dues or direct payment alternatives to keep your benefits active.

- Explore external insurance options if coverage has already been affected.

Disability for Federal Can Help

At Disability for Federal, we work with federal employees to help them navigate changes in union membership and maintain access to reliable supplemental insurance.

We offer:

- Life insurance plans tailored to your stage of life

- Dental, vision, and health coverage options

- One-on-one guidance to help you choose the right plan based on your current situation

Final Thoughts

The union dues suspension already affects how federal employees access important benefits. Understanding how this change impacts your insurance—and taking proactive steps—can help you stay protected and avoid gaps in coverage.

📩 Have questions about your current insurance or need alternatives?

Contact Disability for Federal today to secure the protection you and your family deserve.